Bio-pesticide, as an industry which should

enjoy a bright future, encounters quite a lot of difficulties in China during

its development. However, a great deal of beneficial policies from the Chinese

government would better help bio-pesticide overcome different tasks, CCM research indicates.

Source: Bing

Currently, there are over 40 R&D

institutes of bio-pesticide in China, which keeps up with the world in the

abilities in research and development. Moreover, there are over 80

registrations of bio-pesticides in China with over 2,500 products in the

market, according to CCM’s external expert, Wang Jianwo, secretary general of

Hunan Pesticide Industry Association.

However, the bio-pesticide industry

develops quite slowly in China. The total revenue of 843 pesticide enterprises

with considerable scales in China reached USD48.3 billion in 2014, up 7.5%

YoY. Among the 843 enterprises, the total revenues of 130 bio-pesticide

enterprises and microbial pesticides were only USD4.403 billion in 2014, accounting

for less than 10% of the total revenues of 843 pesticides enterprises,

according to CCM’s new report of Development

of Bio-pesticide Industry in China.

Problems

existing in bio-pesticides industry

In fact, several barriers are hindering the

development of bio-pesticides: the holding back from the pesticides

manufacturers, the sluggish development on R&D of bio-pesticide, and farmers’

reluctant use of bio-pesticides, analyzed in Development of Bio-pesticide

Industry in China, CCM’s report.

Most bio-pesticide manufacturers are

small-scale in China. With large investment but long and slow returns, the

manufacturers are holding back in investing in bio-pesticide.

At present, there are more than 240

bio-pesticides enterprises in China. Among them, there are only a few

enterprises like Hebei Veyong Bio-Chemical Co., Ltd., Wuhan Kernel Bio-te.00ch

Co., Ltd., etc. have a certain size, but the vast majority is small

enterprises. These enterprises lack technical staff and financial

resources, and they have small-scale production, single

species and vulnerability to market shock.

“The product of beauveria bassiana has been studied for more than 20 years while

still has not yet been commercialized”, stated Hu Qiuyi, general manager

of Shanxi Kegu Bio-pesticide Co., Ltd. “It has affected the company’s follow-up

investment in R&D.”

When it comes to the R&D in

bio-pesticide industry, bio-pesticides study is mainly conducted by

research institutes. The vast majority of China's

bio-pesticide enterprises own no research and development institutions for

new products, while they focus on the production of formulation.

Research and production are carried

out by different departments whose interests are not

related, thus the research and technology achievements cannot

be transferred into production. What's worse, there are few

studies about the intermediate of the industrial fermentation process, the

product toxicity and the environmental behavior, CCM’s report of Development of Bio-pesticide Industry in

China indicates.

Most of the farmers prefer chemical

pesticides rather than the bio-pesticides, because bio-pesticides are of slow

effect and higher price than chemical pesticides.

It usually takes one or two days for the

bio-pesticides to take effect. Along with the relatively higher price of

bio-pesticide, it's hard for farmers to use them widely. What's

worse, due to these objective reasons, the companies are reluctant to maintain

production and promotion.

Beneficial

policies to encourage bio-pesticide development

With the support of the policies from the

Chinese government, the bottleneck in the bio-pesticide development could be

broken.

In recent years, the Chinese government has

continuously released a series of policies to hinder the development of

chemicals fertilizers. That’s to say, the development of bio-pesticides is

being greatly supported, indicated

by Development of Bio-pesticide Industry

in China.

Keys on Planting Industry 2015 released

by China’s Ministry of Agriculture in Jan. 2015 pointed out that China should

promote the pesticides with high-effect, low-toxicity and low-residue to meet

with the goals of Zero Increase in the use of fertilizer pesticides.

Bio-pesticide, safer and more environmental

friendly in application, would be highly promoted by the government.

In fact, during the past few years, some

products of bio-pesticide have been successfully promoted. For example, the new

type of anthraquinone compounds, a natural agricultural fungicide, is listed in

the promotion products of China Spark Program, a program to develop rural

economy in China. It was also certificated for organic and natural cosmetics by

ECOCERT in European Union.

This kind of fungicides succeeds 90% in

preventing diseases. The vegetables and fruits can be eaten the next day after

the fungicide is applied. Since 2008, anthraquinone has been applied in over 1.33

million ha.

Some

related policies on bio-pesticide or pesticide industry in China, as of 2016

|

Time

|

Issuing institution

|

Policy/regulation

|

Content

|

|

2016

|

The Ministry of Agriculture

|

The 13th Five-year Plan

|

Increase the pesticide waste disposal

rate from 20% in the 12th Five-year Plan to 30%, and the

rate of by-product utilization to 30% in 2016.

|

|

2015

|

The State Council

|

Several Opinions on Implementation

of New Concept of Development, Speeding up Modernization of Agriculture and

Realizing a Well-off Society

|

Start-up the action of Zero Increase in

the use of fertilizer pesticides and the pesticide utilization rate of both the

fertilizer and main crops will exceed 40% till 2020.

Promote the fixed-point operation of high

toxicity pesticides and demonstration subsidies of low toxicity and low

residue pesticides.

|

|

2011

|

The State Development and Reform

Commission

|

The Guidance Catalogue for the Industrial

Structure Adjustment

|

The guidance pointed out that it will

limit the production of pesticide technical with high toxicity, high residue

and great influence on the environment

|

|

2010

|

China's Ministry of Industry and

Information Technology

|

Plan of Relocation of Pesticide

Manufactures

|

The production of pesticides in China

will be more centralized. Till 2015, over 50% of total pesticide

manufacturers in China would be relocated into chemical parks, and the number

of relocated manufacturers will exceed 80% by 2020.

|

Source: Excerpted from Development of Bio-pesticide Industry

in China

Note:

It is not the same chart as it is in the report. Some information has been

deleted in the chart above.

Moreover, according to the Chairman of the

Institute for the Control of Agrochemicals, Ministry of Agriculture (ICAMA)'s

Biological Test Chamber, the new registration policies will give more

support to bio-pesticides registration, such as cutting down the efficacy

test time of bio-pesticides from two years to one year, etc. This will help the

bio-pesticide manufacturers reduce the registration time and seize the market

opportunities.

With all the policies mentioned above, CCM’s report of Development of Bio-pesticide

Industry in China forecasts that the domestic supply and demand for

bio-pesticides will show a slight increase in the next five years (2016-2020).

In 2015, the bio-pesticides accounted for

about 10% of the total pesticide market in China. In the next five years

or more, it is expected that the bio-pesticides will not replace the chemical

pesticide completely, but they will gradually substitute some chemical

pesticides, and coexist with those high-effective and low-toxic ones in the

future, forecasted in Development

of Bio-pesticide Industry in China.

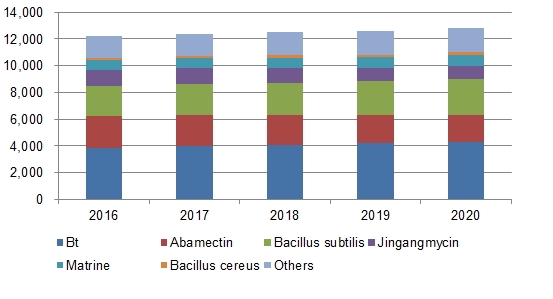

Forecast

on supply of major bio-pesticides in China, 2016-2020

Source: Development of Bio-pesticide Industry in China, CCM

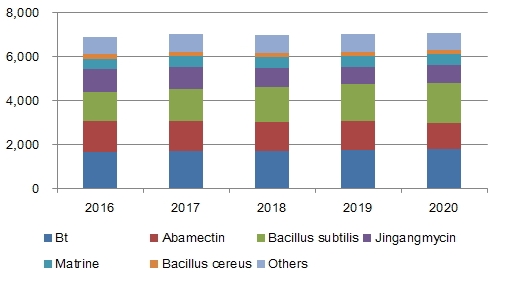

Forecast on demand for major bio-pesticides

in China, 2016-2020

Source: Development of Bio-pesticide

Industry in China, CCM

In CCM’s new edition of Development

of Bio-pesticide Industry in China, you could find out the latest

information of the major bio-pesticides about history, registrations,

technology, raw material, production, export and import, consumption and forecast. Information about 8 kinds of major bio-pesticides is

included in the report – bacillus thuringiensis, abamectin, jingangmycin, bacillus

subtilis, bacillus cereus, matrine, oligosaccharins, and brassinolide.

If you would like to learn more the

bio-pesticide industry in China, you could visit Development

of Bio-pesticide Industry in China or contact us by emailing econtact@cnchemicals.com or

calling +86-20-37616606.

About

CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include

Monsanto, DuPont, Shell, Bayer, and Syngenta.